SAAS for Equity & Venture Capital Firms

Transforming Venture Capital and Equity Management through streamlined GP-LP operations, enhanced investor relations, and optimized back-office processes.

Project Duration

6 Months

Team Size

9 Specialists

Operational Efficiency

75% Increase

Project Overview

Client

San Francisco-based VC Firm

Industry

Venture Capital & Financial Services

Services Provided

- SaaS Platform Development

- Custom UX/UI Design

- Data Migration

- System Integration

- Training & Implementation

Technologies

The Challenge

The venture capital landscape has grown increasingly competitive and complex, creating multifaceted challenges for our client. Managing investor relationships had become increasingly difficult with growing LP numbers and diverse reporting requirements. The firm struggled with disparate systems for capital call processing, distribution calculations, and performance reporting, leading to data inconsistencies and potential errors. Fund administrators spent excessive time manually preparing quarterly reports and responding to ad-hoc investor inquiries, diverting attention from value-added activities.

The firm lacked centralized data management for waterfall calculations, hurdle rates, and carried interest distributions, making accurate and timely GP compensation nearly impossible to calculate efficiently. Compliance requirements and investor transparency demands had intensified, creating additional administrative burdens without corresponding increases in back-office headcount. The firm's leadership recognized the need for a comprehensive solution that could not only address these immediate pain points but also scale with their future growth plans.

The Solution

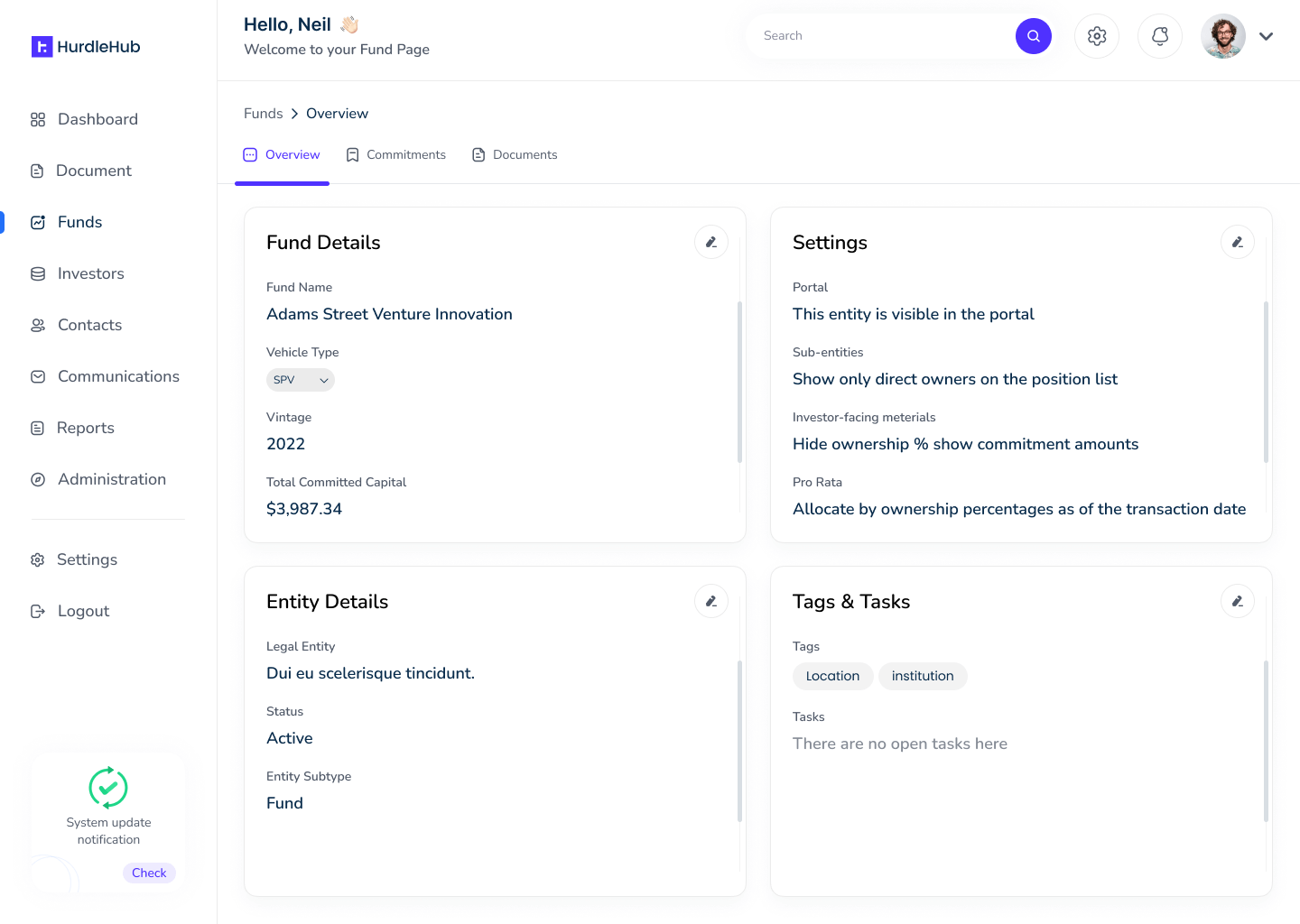

HurdleHub was implemented as a comprehensive SaaS solution to transform the client's GP-LP management processes. The platform was built with modern technologies—Laravel for robust backend functionality, Vue.js for a responsive frontend experience, and MySQL for secure and scalable data management. A distinctive feature of the implementation was the creation of a custom UX/UI designed specifically for venture capital workflows.

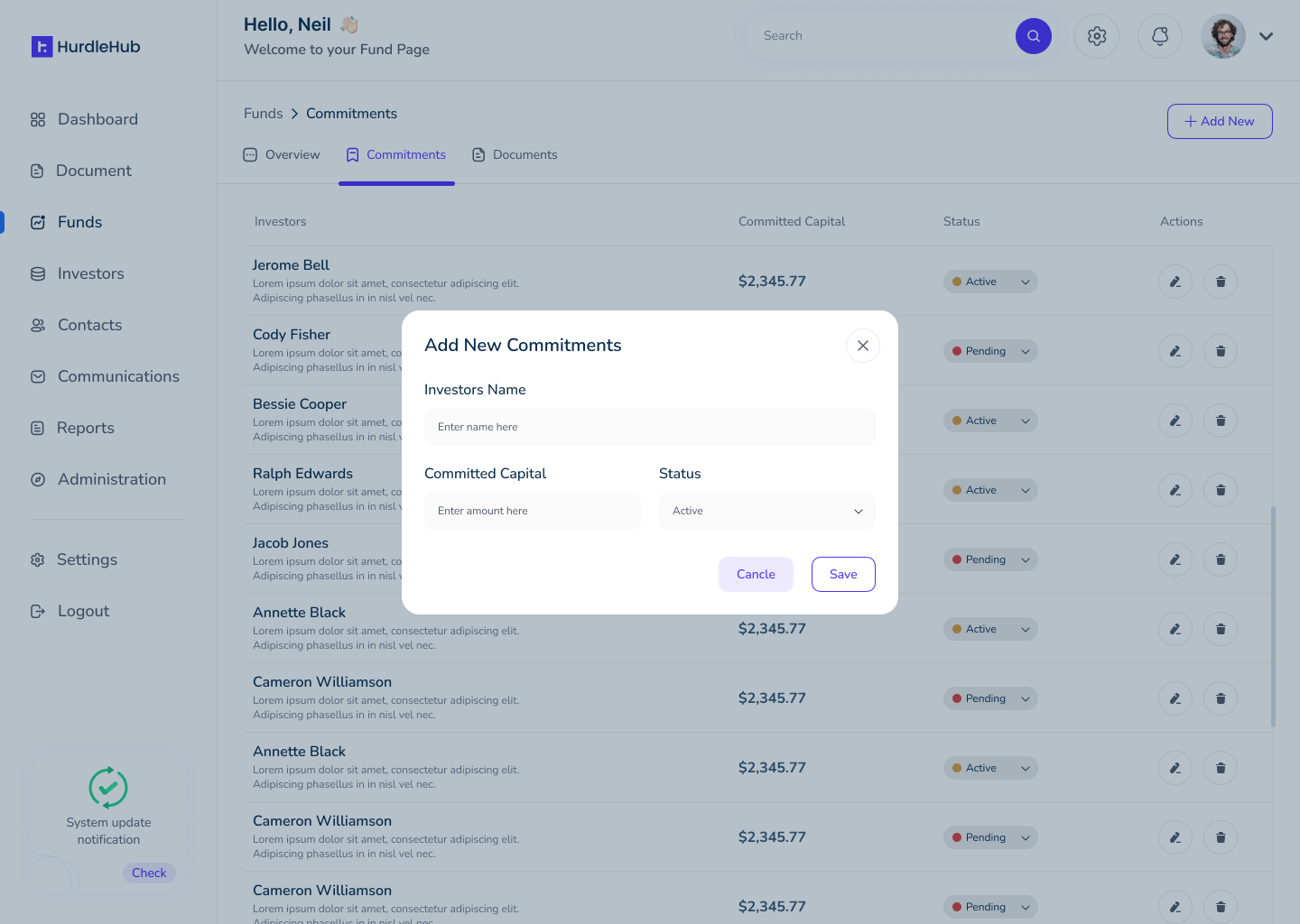

The solution includes a centralized investor portal where LPs can access their investment statements, capital call notices, distribution information, and fund performance metrics. Advanced tools for managing complex fund structures, including multi-tiered waterfall calculations, carried interest modeling, and management fee calculations automate the generation of financial statements and performance reports. A streamlined system for processing capital calls and distributions with automated notification, tracking, and reconciliation features rounds out the core functionality.

Development & Implementation

- - Comprehensive discovery and requirements analysis to assess existing processes

- - Data migration from legacy systems while maintaining data integrity

- - Custom configuration to match specific fund structures and LP agreements

- - Phased rollout starting with core fund accounting and investor relations

- - Extensive user training and change management to ensure adoption

The Results

75%

Reduction in reporting time

40%

Increase in LP satisfaction

30%

Decrease in admin costs

"HurdleHub has transformed our back-office operations from a constant pain point to a strategic advantage. The custom UI/UX perfectly aligns with how our team thinks about fund management, and the automation capabilities have eliminated countless hours of manual work. Most importantly, our limited partners have noticed the difference in the quality and timeliness of our reporting. The platform has scaled seamlessly as we've launched new funds, and the insights we gain from the analytics dashboard have become an essential part of our strategic planning process." — Managing Partner, San Francisco-based Venture Capital Firm

Real Results from Real Partners

Don't just take our word for it. Our clients have launched successful products, scaled their businesses, and built software that actually works.

Neil Arora

Entrepreneur

Kenelm Tonkin

CEO, Tonkin Corporation

Lisa Oda

Head of Content, Upwork

Nahid and his team helped build our WordPress site under tight deadlines with many moving parts. He was extremely gracious and helpful throughout.

Kenelm Tonkin

CEO, Tonkin Corporation

Worked more than 5 years with them on different web development Projects & I must say, I always got 100% of what I wanted. Highly recommended.

Mukit Ur Rahman

Senior Product Manager, Sheba xyz

We had to outsource some of our projects at Sheba Platform Ltd. Nahidul Islam and his teams prompt support and pro-activeness made sure that all the projects were delivered on time

John Francis

CEO, Sixfold Digital

Nahid and the teams work goes much deeper than purely executional. They have an acute understanding of the why behind what they are building.

Ali Jafri

CEO, Mental Development

This was a long term project and Nahidul was very patient as we worked through this rebuild. Nahidul is very easy to work with and very skilled

Erickson Del Villar

CEO, ESDS

As always Nahid was excellent and delivered the tasks in time.. very dependable..highly recommended

Ready to Transform Your Financial Operations?

Let's discuss how we can help you achieve similar results for your venture capital or equity management firm.